FintegrationFS specializes in crypto banking platform development for the US market with deep expertise in American regulatory frameworks and security standards.

Our US Market Expertise:

-

15+ years building fintech solutions for US clients

-

100+ production-ready fintech applications deployed

-

Official partnerships: Plaid, Quiltt, Straddle, Dwolla

-

SOC2 Type II certified development processes

-

100M+ end users served across US platforms

-

$500M+ processed in blockchain transactions

We Understand US Compliance: FinCEN MSB registration requirements, BSA/AML protocols, OFAC screening, state-by-state money transmitter licensing, SEC digital asset regulations, and FDIC deposit insurance integration.

Proven Track Record Serving US Financial Institutions

The Competitive Threat Is Real

67% of US millennials want crypto services from their primary bank. While you're deciding, crypto-native platforms are capturing $15B+ in deposits from traditional banking customers.

Market Reality in the US:

-

Coinbase has 108M+ verified US users (2025)

-

PayPal and Venmo offer crypto buying in all 50 states

-

Major US banks (JPMorgan, Citi, BNY Mellon) already launched institutional crypto services

-

State-chartered crypto banks (Kraken, Anchorage) are winning regulatory approval

-

First-mover advantage window is closing fast

Without crypto banking capabilities, you risk losing your most valuable customers to competitors who offer unified fiat + crypto experiences.

WHY US BANKS NEED CRYPTO BANKING

Why Financial Institutions Need Crypto Banking Solutions

The Digital Asset Revolution Is Here

Cryptocurrency adoption has reached an inflection point. Global crypto ownership surpassed 560 million people in 2025, with transaction volumes exceeding $15 trillion annually. This massive shift creates both opportunity and urgency for financial institutions.

Market Drivers Accelerating Adoption

-

Institutional investment has legitimized digital assets. Major banks like JPMorgan and Citibank now offer crypto services to clients. Regulatory clarity emerged through comprehensive frameworks in the US, EU, and Asia. Stablecoins bridge crypto volatility with fiat stability, enabling practical payment applications. Central Bank Digital Currencies (CBDCs) validate blockchain technology for monetary systems. Corporate treasuries hold Bitcoin and Ethereum as reserve assets.

Competitive Pressure Intensifies:

-

Crypto-native platforms like Coinbase and Crypto.com capture market share from traditional banks. Neobanks such as Revolut and Wirex offer integrated crypto services, attracting younger demographics. Payment giants including Visa and Mastercard enable crypto transactions on their networks. Big tech companies explore digital wallet integration with crypto capabilities.

Customer Expectations Evolve:

-

67% of investors want to manage crypto alongside traditional accounts in one app. 73% of high-net-worth individuals demand institutional-grade crypto custody from their banks. Businesses require crypto payment processing, treasury management, and cross-border settlement solutions. Gen Z and millennials view crypto services as a baseline banking feature, not an add-on.

Relevant Case studies

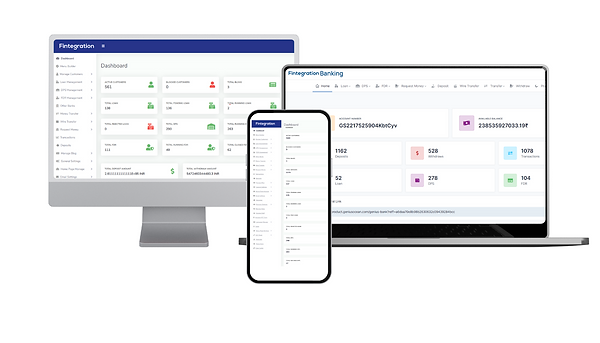

Launch in 3 Months with Our Pre-Built Platform

Skip 60% of custom development with our white-label crypto banking platform built specifically for US compliance.

What's Included Out-of-the-Box:

1) Multi-currency wallet (BTC, ETH, SOL, USDC, USDT)

2) KYC/AML workflows (Persona integration)

3) Buy/sell crypto with ACH (Plaid + Dwolla)

4) Crypto debit card (Marqeta integration)

5) iOS & Android mobile apps

6) Web admin dashboard

7) FinCEN reporting tools

Customization Options:

-

Your branding (logo, colors, domain)

-

Additional cryptocurrencies/blockchains

-

Custom features (lending, staking, NFTs)

-

Integration with your existing systems

WHITE-LABEL CRYPTO BANKING SOLUTION

Crypto Banking Solution Technology Stack

Blockchain Integration Layer

Financial Service Provider Integrations

Build innovative fintech mobile app development solutions beyond traditional banking. Our expertise spans the entire fintech ecosystem, enabling you to launch products that address specific financial needs.

Banking & Account Aggregation

Payment Processing

Identity Verification & KYC

WHY CHOOSE FINTEGRATIONFS

What Sets Us Apart in Crypto Banking Development

1. US-Focused Fintech Specialists

Unlike offshore agencies doing everything, we exclusively build fintech solutions for US markets. We understand FinCEN, state banking departments, FDIC, SEC, CFTC – not just blockchain.

2. Official Fintech API Partnerships

-

Plaid Partner (Official) – Bank account connectivity

-

Straddle – Stablecoin payment infrastructure

-

Quiltt – Modern banking APIs

-

Dwolla – ACH payment processing

3. Pre-Built Compliance Framework Our 30+ reusable fintech components

-

FinCEN CTR/SAR reporting modules

-

OFAC sanctions screening APIs

-

Multi-state money transmitter workflows

-

IRS Form 1099 generation

-

Automated KYC/AML monitoring

4. Battle-Tested at Scale

-

100M+ end users served

-

$500M+ in blockchain transactions processed

-

100+ production fintech apps deployed

-

90+ full-time developers (not contractors)

5. US-Based Account Management

-

Austin, Texas headquarters for US clients

-

US business hours (CST/PST) communication

-

In-person meetings available

-

English-native project managers

-

No language or cultural barriers

6. Transparent, Fixed-Scope Pricing

No hidden fees, no scope creep, no surprises:

-

Detailed project plan with milestones

-

Fixed-price contracts (not T&M)

-

Monthly progress demos

-

Clear deliverable definitions

-

Performance guarantees in writing

Global Team, Local Presence

Development Centers

India (Ahmedabad)

USA (Austin, Texas)

UAE (Planned Expansion)

Communication Excellence

Work seamlessly across time zones with:

Daily standup meetings via Slack/Teams

Bi-weekly sprint reviews with demos

Real-time project tracking (Jira, Linear)

Dedicated account manager

24/7 critical issue support

Comprehensive documentation

Ongoing Support & Partnership

Post-Launch Commitment We don't disappear after launch. Our ongoing support includes:

-

24/7 production monitoring and alerting

-

Rapid response to critical issues (< 2 hour SLA)

-

Regular security updates and patches

-

OS compatibility updates for new iOS and Android releases

-

Performance optimization based on usage data

-

Compliance updates as regulations evolve

-

Feature enhancements and improvements

.avif)

.avif)

.png)